- LOOKUP EIN BY COMPANY NAME HOW TO

- LOOKUP EIN BY COMPANY NAME LICENSE

- LOOKUP EIN BY COMPANY NAME FREE

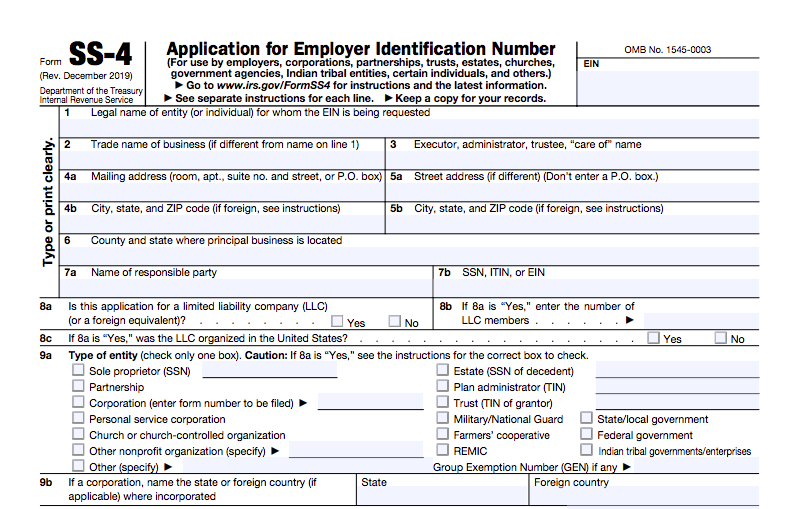

Most often than not, businesses contact the IRS only when they have lost or misplaced their Employer Identification Number (EIN). One of the most common ways to find an EIN number is by contacting the Internal Revenue Service directly. The Form CP 575 contains the EIN number allotted to a business and this letter is sometimes used by businesses for EIN look up. When a business applies for an EIN by submitting Form SS-4, the Internal Revenue Service (IRS) issues a Form CP 575 after two weeks post approval to confirm that an Employer Identification Number (EIN) that has been issued for the business in question. Yes, this is a form that will help you find an EIN number so that you can provide it to the bank. In such a scenario, what do you do? This is where the form CP575 comes to the rescue. You want to open a bank account for business transactions and your bank asks for a confirmation regarding the issue of the EIN. You have formed a company and applied with the IRS for an employer identification number. In order to understand what the confirmation letter is and how do you find EIN, let’s look at an example: One of the ways to find an EIN number is with the help of the employer identification number (EIN) confirmation letter. Find EIN number from EIN confirmation letter There can be any number of reasons why you may need to find your business tax ID number but the question is how you go about looking up your EIN. There are other times when you may need to find your own EIN for an important business related application. There is always a probability that you may need to find the EIN of another company you are planning to do business with. The bottom-line is that if you are unable to remember your EIN number when filing an important document then the filing may get delayed, which could be unprofitable for the business.Īn EIN look up is a process by which you can find this unique nine-digit business tax ID number of your company as well as any other business in the US. In such a scenario, if you don’t remember the number, you can find the EIN number using different resources.

LOOKUP EIN BY COMPANY NAME LICENSE

Sometimes, you may require this business tax ID number for a loan application or for any other important business requirement like application for business license or even to hire employees. It is important to know your EIN because once you have this business tax ID number, it may fulfill a wide variety of purposes including filing of tax returns. It is also used for providing tax statements of a specific entity to the tax lawyers. Why is it important to know your EIN?Īn Employer Identification Number (EIN) is a unique nine-digit number, which is primarily used for identification of a business for tax purposes. There are a wide variety of businesses like Business Corporation and partnerships that require this tax ID number and it is also required when the ownership or structure of a specific business entity has changed. This tax ID number is used for identifying a business entity and hence sometimes businesses use EIN look up resources to check their own EIN or that of other companies. This is a mandatory requirement and is issued by the Internal Revenue Service (IRS). When you form or register a new business in any state in the US, you will also have to simultaneously apply for the federal tax ID also known as an employer identification number (EIN). Since, most businesses have to obtain an EIN prior to transacting in any state in the US, you can also use several resources to find EIN numbers for other businesses as well.

LOOKUP EIN BY COMPANY NAME HOW TO

IRS: Topic Number 755 - Employer Identification Number (EIN) – How to Apply.IRS: How Can I Look Up a Tax ID for a Business?.Nolo: When Does a Sole Proprietor Need an EIN?.

LOOKUP EIN BY COMPANY NAME FREE

0 kommentar(er)

0 kommentar(er)